Porsche 993: General Information and Insurance Guide

While we all know the sticker price for a Porsche 993 can be a bit high, one thing new owners often do not consider is the high rates they'll have to pay to insure their new vehicle.

This article applies to the Porsche 993 (1993-1998).

One thing most people don’t consider when purchasing a Porsche 993 is the automobile insurance that comes with owning a vehicle as such. There are several reasons why a high-end car like this comes with such expensive coverage. The good news is, there are many different ways for the Porsche owner to go about saving money so that their investment of owning their “dream car” doesn’t turn into a nightmare of overdue bills.

The biggest reason why insurance on a Porsche is so high

While owning a Porsche is a dream for most, it can be a bit of a nightmare when it comes to the cost of higher annual rates.

The reason why insurance on a Porsche is so high is not due to the fact that the vehicle is seen as a risk. Quite the contrary actually. Porsche is an exceptionally built vehicle, and the 993 in particular is viewed by many to be one of the best built sports cars to date.

No, the risk is actually with the driver. You see, Porsche drivers tend to get a lot of speeding tickets. Less so, but still worth noting, these drivers also tend to get in to more speed-related accidents, and also have a tendency to involve themselves in street races.

While no Porsche driver will ever admit to being a driver as that which is described above, chances are, if you talk to other Porsche drivers and car enthusiasts, you know someone who does speed, gets into accidents, etc. And they’re the reason why insurance companies view Porsche drivers as a risk factor.

Another reason — the Porsche 993 is too attractive

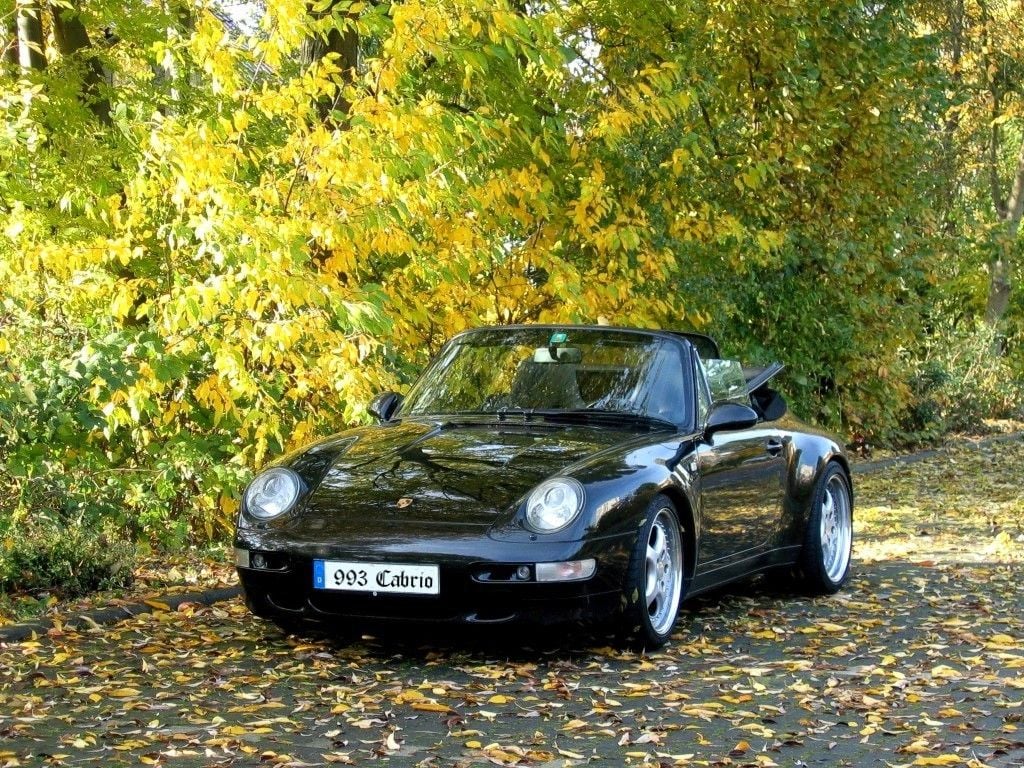

This is kind of stating the obvious, but the Porsche 993 is an attractive car. It has all the finer qualities founds in its 911 predecessors, wrapped together in a sleek, sports car package.

Now, this is a double-edged sword. As much as the vehicle attracts eyes on the roadway, it also attracts the attention of car thieves who are in the business of stealing these cars and reselling them or their parts. As such, owning such a deemed more appealing to thieves than your standard Toyota, Honda, or Ford vehicle is deemed risky for insurance companies.

Location plays a big part

By now, I think we’re all pretty well informed of the fact that where you live plays a big factor in to just how much you’ll wind up paying for car insurance. Typically speaking, those who live and drive in the “country” will enjoy lower rates than those who live and drive in the city.

So, do expect your region and how the company views your Porsche 993 to play a big role in the overall annual rate you get on your insurance policy.

Choosing the right company

While the insurance rates a Porsche owner will have to pay are higher than most, the good news is they’re not standard across the board. There are several companies that offer car insurance, and they all compete with one another on price by way of various deals and offers.

Take, for example, Geico — the “15 minutes or less” insurance company offers several different bundled insurance programs that allow car owners to bundle their automobile insurance together with their home insurance policy for the purpose of enjoying a discounted rate on both plans. Several other companies sell similar offerings, including Allstate, State Farm, Liberty Mutual, and more.

Take the time to shop around. While the first quote might be a bit discouraging, in all likelihood, you’ll be able to find something better with just a few clicks of the mouse.

How to lower (or otherwise maintain) your insurance rates

Maintain a clean driving record — that means no speeding tickets, accidents, or anything that would cause your insurance company to deem you any more of a risk than their original assessment.

Keep your credit score in good standing — a drop would cause the insurance company to question whether or not you can continue to make payments on your car and the insurance policy. This would, obviously, increase your level of “risk” factor in their eyes.

Add a second driver to your policy — discounts are generally associated with expanded coverage plans. Also, if you and your partner are both good drivers with clean records, it will help solidify your good standing with the insurance company and decrease your “risk.”

Stay with one insurer — some companies offer discounts to dedicated cliental.

Explore the option of mileage limitations — if you’re only driving your Porsche 993 on the weekends, then relay this information to the insurance company. Some offer discounts for second vehicles that are only on the road for a few thousand miles a year.

Constantly inquire if you’re subject to any discount programs — each company has its own set of unique offerings, so they can be a bit tough to track. A quick call to a company representative will give you exclusive insight into new ways you might be able to save even more money.

Related Discussion

- Insurance - Rennlist.com