Porsche 997: Extended Warranty Buyers Guide

What is an extended warranty? Are some warranties better than others? There are several different types of extended warranties to choose from, some of which offer more comprehensive coverage than others.

This article applies to the Porsche 997 (2005-2012).

Purchasing an extended warranty isn't a requirement, but many owners find that it pays to have some sort of additional coverage as their vehicle ages. This is particularly true for older European cars, which tend to require more maintenance as their age and mileage increases. If you're considering extended warranty for your car, you probably have several concerns. Some of the most common questions include what sort of coverage an extended warranty covers and whether certain warranties are more comprehensive -- or better -- than others. While some owners believe that this type of warranty isn't worth the extra cost, others have saved a lot of money through extended warranty. Before making a final decision, it's best to compare a few different types of warranty as well as their prices to find the most suitable option.

What is an extended warranty?

If you're considering purchasing an extended warranty, you probably want to know what it offers. This type of warranty is available for newer and older cars and can greatly reduce the cost of repairs, especially as vehicles age. In general, owners of brands that typically cost more to maintain over time are most satisfied with their extended warranties. An extended warranty works similarly to car insurance, where if the vehicle breaks down, you pay your extended warranty deductible (sometimes this is free/$0) and the warranty covers everything else.

Are some warranties better than others?

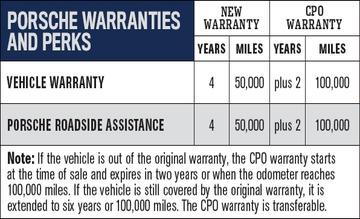

Many owners find their extended warranties directly through Porsche or an aftermarket/third party company. Common examples include Costco, Fidelity, and Easycare. Depending on the age, mileage, and overall condition of your car, one type of warranty may be a better fit than another. Each company typically offers a few different coverage options based on your budget and your car's age and mileage.

Are extended warranties worth the extra cost?

In general, the cost to purchase extended warranty directly through the dealership or through a third party is similar. Porsche owners who pay more upfront for a more comprehensive coverage tend to be more satisfied with their warranty than owners who opt for less comprehensive coverage. Although they're often pricier up front, most bumper-to-bumper coverage plans cover more potential faults along with expenses such as rental car coverage or towing.

What should I look for before deciding to buy extended warranty?

Once you're ready to buy an extended warranty, you'll want to take the plunge when you're not feeling pressured or rushed, as can often happen at a dealership when you're buying a used car. It's best to think ahead to determine the right plan for your budget and vehicle needs. For example, it might be a good idea to pay a little more up front for a plan that covers your car up to a certain mileage, such as 100,000 miles. Comparing lower-end warranties to pricier ones can give you a clear sense of whether you'll only be covered for major mechanical breakdowns or wear and tear items as the vehicle ages.

Other considerations when buying extended warranty

If you're ready to buy extended warranty, there are other points to consider as well. It might seem like most plans have a set price, but more often than not you may be able to negotiate a better price. In fact, a bit of bargaining can save you hundreds of dollars up front. The dealership may tout its extended warranty options, but you might find better deals through different sources, such as your insurance company or auto club. Despite what you might think, there's not much of a cost difference between bumper-to-bumper coverage and limited coverage. If you plan to buy the car and keep it for awhile, you should strongly consider purchasing a full protection coverage plan.

Related Discussions

- Fidelity vs. Easycare Warranty - Rennlist.com

- Is Porsche Extended Earranty Worth It? - Rennlist.com

- Extended Car Warranties - Consumerreports.org